Sp Ed Personnel Revenue Offsets for Sp Ed Tuition Cost Sheets

Public Act 100-465 or the Evidence-Based Funding (EBF) for Student Success Act enacted on August 31, 2017, integrated funding for five programs including Special Education Personnel. Previous to PA 100-465, the Special Education Personnel program provided reimbursement for a portion of prior year compensation costs for staff who were employed or contracted by a district or special education cooperative. Full-time licensed personnel employed 180 days were reimbursed a maximum of $9,000. Licensed paraprofessionals and other non-licensed personnel were reimbursed a maximum of $3,500.

Currently, ISBE is in the process of amending the Part 130 Special Education Per Capita Tuition Cost rules to account for the changes to the Special Education Personnel program. One of the primary amendments to this Part requires that all full-time licensed, paraprofessionals and non- licensed personnel who are included for computation of special education program costs will have their compensation offset using the Special Education Personnel funding each district or cooperative received as part of their base funding minimum at the traditional amounts of $9,000 and $3,500, respectively. This is being done to maintain consistency of special education program costs as EBF is implemented. The per capita expenditures and offsets are integral to the computation of individual student amounts that are billed to other Local Education Agencies or filing state special education claims under Section 14-7.03 (Special Education Individual Orphanage) or Section

14-7.02b (Special Education Excess Cost).

To assist users in how the revenue offsets should be apportioned to staff, please see the following link for additional narrative and common examples https://www.isbe.net/Documents/EBF-Sp-Ed-Personnel-Offset-Examples.pdf.

Questions about the Evidence Based Funding program should be directed to EBFHelp@isbe.net.

Questions regarding the Special Education Tuition Cost Sheet should be directed to Jodi Whitlow jwhitlow@isbe.net, phone (217) 782-5256.

Questions pertaining to the operation of I-Star should be directed to Harrisburg Project support@hbug.k12.il.us, phone (800) 635-5274.

Tim Imler

Division Administrator

Funding and Disbursement Services

Illinois State Board of Education

Phone: 217-782-5256

Fax: 217-782-3910

April, 2018

To: Districts and Special Education Cooperatives

From: Tim Imler

Division Administrator

Division of Funding and Disbursements.

Subject: Special Education Personnel Evidence Based Funding Offsets for Special Education Tuition Cost Sheets

Public Act 100-0465 or the Evidence-Based Funding (EBF) for Student Success Act enacted on August 31, 2017 integrated funding for five programs including Special Ed Personnel. 2015-16 Sp Ed Personnel claims were reimbursed at 100% in fiscal year 2017 and represented the final distribution computed under formula. Beginning with fiscal year 2018, Sp Ed Personnel funding is being distributed as part of each district/cooperative’s guaranteed/hold harmless base funding minimum (BFM).

ISBE is in the process of amending the Part 130 Sp Ed Per Capita Tuition Cost rules. One of the primary amendments to this Part requires that all full-time licensed, paraprofessionals and non-licensed personnel who are included for computation of special education program costs will have their compensation offset using the Special Education Personnel funding each district or cooperative received as part of their base funding minimum at the traditional amounts of $9,000 and $3,500, respectively. This is being done to maintain consistency of special education program costs as EBF is implemented.

Districts/cooperatives are not required to align the statutory amounts by staff name or special education program from year-to-year; however, the amount of Sp Ed Personnel BFM allocated to each district/cooperative must be allocated at the formula levels for each full-time licensed teachers (i.e. $9,000) or paraprofessionals (i.e. $3,500) who may be included in a special education program.

Although staffing and their ratio of time to programs may vary year to year, the Sp Ed Personnel base funding amount prior to entering the staff allocation ratio will stay constant to their category (i.e. certified or non-certified). The total BFM revenue offset entered for all staff who are allocated on a district/cooperative cost sheet cannot exceed the total Sp Ed Personnel BFM.

If total staffing decreases year-to-year, the static Sp Ed Personnel BFM amount may be decreased accordingly by the district/cooperative; if staffing increases, the Sp Ed Personnel BFM amount shall be spread proportionally across all existing and additional staff.

The following provides some common examples as to how the revenue offset should be apportioned for staff whose compensation costs are entered on a program cost sheet.

1. Locate Base Funding Amount set from 2015-2016 personnel reimbursement file for district: https://www.isbe.net/Pages/ebfdistribution.aspx

Column F – Sp Ed Personnel – 100% gross

Example:

![]()

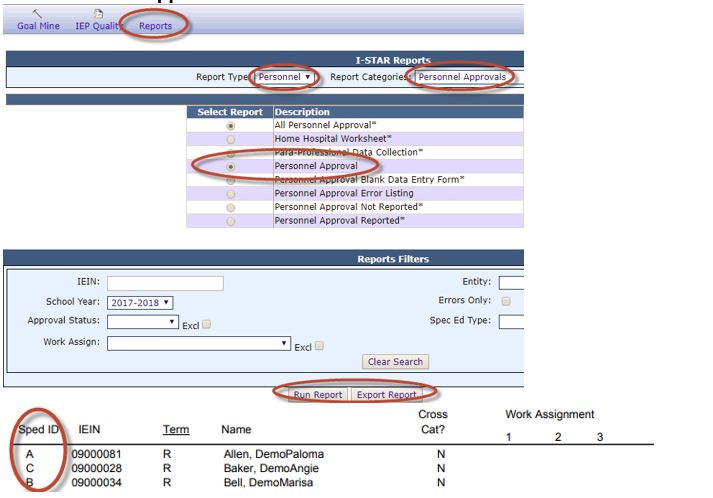

2. Determine the current year apportionment of Special Education Personnel base amount:

-

Run Personnel Approval in I-Star

- Determine number of personnel under each status code:

Status Code A: Special Education Teachers $9,000

Status Code B: Special Education Related Service Providers $9,000

Status Code C: Special Education Paraprofessionals $3,500

Status Code D: Special Education Administrators and Supervisors $9,000

- Determine EBF Offset per staff member involved in cost centers/programs:

Beginning in FY 18:

Example with BFM = $344,002

![]()

If staffing levels remain static by category and apportionment is $344,002:

EBF Offset for Personnel involved in student cost centers/programs:

Special Education Teachers $9,000

Special Education Related Service Providers $9,000

Special Education Paraprofessionals $3,500

Special Education Administrators and Supervisors $9,000

If staffing levels decrease:

Status Code A – 20 Status Code C – 10

Status Code B – 5 Status Code D - 2

Status Code A – 20 x $9,000 = $180,000

Status Code B – 5 x $9,000 = $ 45,000

Status Code C – 10 x $3,500 = $ 35,000

Status Code D – 2 x $9,000 = $ 18,000

Total $278,000

EBF Offset for Personnel involved in student cost centers/programs:

Special Education Teachers $9,000

Special Education Related Service Providers $9,000

Special Education Paraprofessionals $3,500

Special Education Administrators and Supervisors $9,000

If staffing levels increase:

Status Code A – 20 Status Code C – 10

Status Code B – 5 Status Code D - 2

Status Code A – 40 x $9,000 = $360,000

Status Code B – 10 x $9,000 = $ 90,000

Status Code C – 15 x $3,500 = $ 52,500

Status Code D – 2 x $9,000 = $ 18,000

Total $520,500

EBF Offset will be pro-rated: $344,002/$520,500=66%

EBF Offset for Personnel involved in student cost centers/programs:

Special Education Teachers $5,940

Special Education Related Service Providers $5,940

Special Education Paraprofessionals $2,310

Special Education Administrators and Supervisors $5,940